Rounding Bottom and Top Patterns

Chart patterns, which take several weeks to develop, offer highly reliable trading opportunity to a binary options trader. A Rounding bottom and Rounding top are two such patterns, which can be thought of a Head & Shoulder formation with no clear demarcation of the shoulders. Thus, minimal efforts are only needed to identify a Rounding bottom / top pattern. However, successful trading of a Rounding bottom / top pattern requires patience on the part of a binary options trader. A binary options trader can reap rich dividends practically risk free by learning to identify these

Figuring Out a Rounding Bottom Pattern

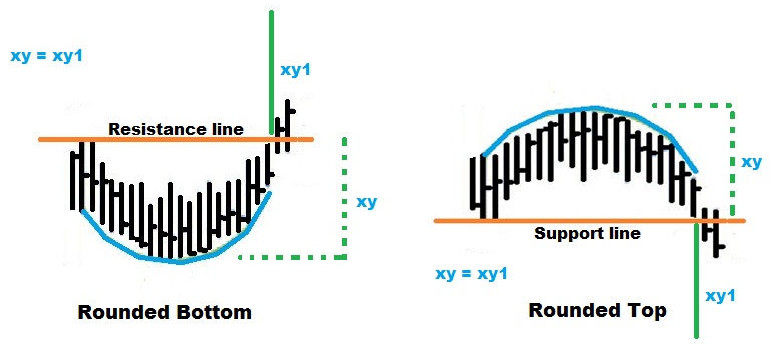

A Rounding bottom is a

A trend line, which acts as resistance, is sketched by joining the minor high at the beginning and end of the downtrend and uptrend respectively. The probable target price is calculated by measuring the distance between the resistance level and lowest price in the pattern and adding it to the former.

The pattern is confirmed based on the following rules:

- The volume should increase when the price declines initially (left side of the bowl formation). During price consolidation, the volume should decrease considerably. Finally, the volume should increase during the formation of the right side of the bowl.

- The pattern should not have a

V-shape . - A rounding bottom pattern should take several weeks to develop.

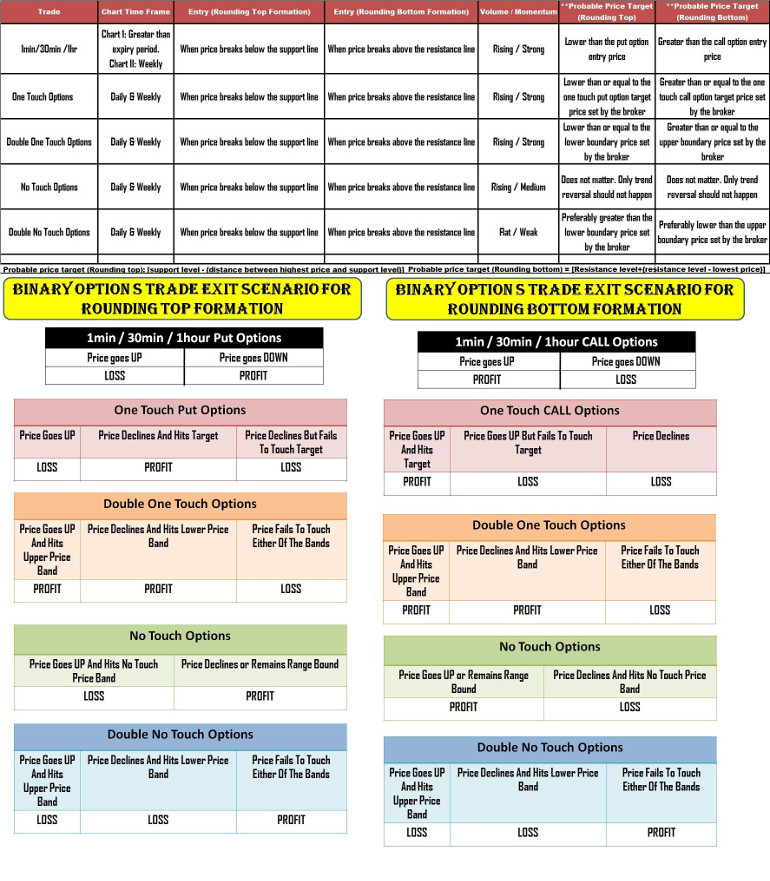

Setting up a binary option trade

1min / 30min / 1hr options: A binary options trader can purchase a 1min / 30min or 1hr call options contract soon after the price breaks above the resistance line. Timing the trade entry is very important. The reason is that the price may retrace and test the broken resistance, which by then will act as a support. The volume should rise when the

For example, to purchase a 30min call options contract, a trader can monitor the weekly chart for completion of the pattern and 1hr chart for entering at the right time.

One touch options

Having identified a rounding bottom pattern, a one touch call options contract can be bought, based on the following criteria, by a binary options trader:

- The probable target price should be greater than or equal to the target price set forth by the broker for the call options contract.

- The volume should rise when the price

break-out above the resistance line happens. The momentum should be strong enough to favour an upward trend.

A binary options trader should enter only after the price

Double one touch options contract

A one touch call option may not yield the necessary result when the price breaks above the resistance line of a Rounding bottom pattern without noticeable rise in volume or with a weak momentum. In such instances, provided there is a scheduled high impact news announcement, a binary options trader can consider buying a double one touch options contract.

The high impact news would fuel a strong uptrend or decline in price. This would ultimately lead to the violation of either the upper or lower boundary price target specified by the options broker thereby leading to a profit (in the money expiry) from the trade.

If the news does not alter the volume and momentum scenario then the price may remain range bound. Under such circumstances the options contract will expire out of money.

No touch options

This is one of the best possible solutions for trading a rounding bottom pattern. Once the price breaks above the resistance line then a no touch options contract can be bought. Since a rounding bottom pattern takes weeks or even months to develop, the break out will be usually strong. Thus, a no touch options contract bought after a break out will usually result in a profit. As it can be understood the volume (increase) and momentum (strong) scenario should favor an uptrend. Unexpected negative news may result in a trend reversal. In such a case, the options contract will expire out of money.

Double no touch options

A double no touch options contract can be bought when the following three conditions are satisfied:

- Price breaks above the resistance level without noticeable increase in the volume.

- Momentum is weak.

- There is no scheduled high impact news announcement.

Once the resistance level is broken the price will remain range bound. Only fresh news can trigger further rise or reversal in price. The criteria mentioned above ensure that the upper boundary price set by the broker remains untouched after the

A sudden rise in the volume accompanied by a gain in the momentum would result in increased price volatility. Such a scenario will result in the price breaching either of the no touch bands thereby making the options contract expire out of money.

Identifying a Rounding Top pattern

A Rounding top is a

A trend line, which acts as support, is drawn by joining the minor lows at the beginning and end of the uptrend and downtrend respectively. Additionally, the distance between the highest price in the pattern and support line is measured. It is then subtracted from the support line to arrive at the probable target price.

The pattern is confirmed based on the following rules:

- The volume should increase when the price rises initially (left side of the inverted bowl formation). During price consolidation, the volume should decrease considerably. The volume should increase again during the formation of the right side of the inverted bowl.

- The pattern should not have a

V-shape . - The pattern should take several weeks to develop.

Trading a Rounding top formation

When the price breaks below the support line of a Rounding top formation, a binary options trader can purchase a suitable contract, which includes a 1min/30min or 1hr put option, one touch put option, no touch option, double one touch option and a double no touch options contract. The volume and momentum should support the price decline. The selected contract is traded in the same manner as a Rounding bottom formation. The only difference is that a price

The rounding top / bottom patterns discussed above are highly reliable and commonly seen in the weekly and monthly charts. As long as a trader is able to confirm the pattern without any errors and choose an appropriate binary option contract, realizing consistent profits will not be an intricate task.

You may also be interested in learning about other chart patterns that can be used to trade binary options: