Rectangle Pattern in Binary Trading

When the price of an asset moves between upper and lower limit for a

Identification of a rectangle pattern

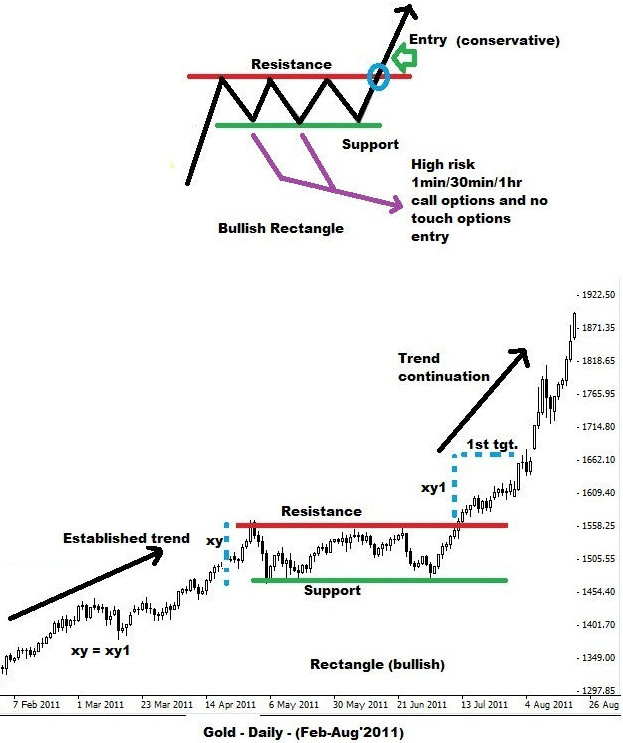

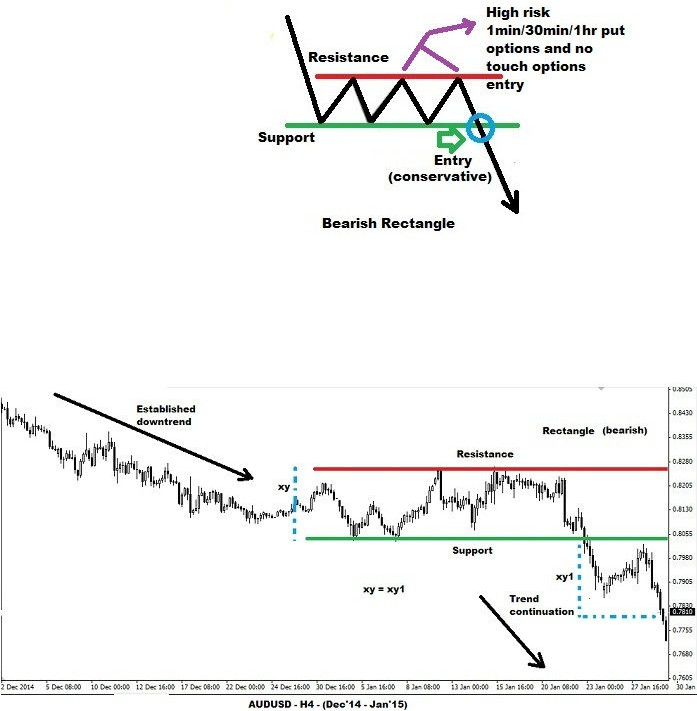

Following an uptrend or downtrend, the price of an asset may temporarily pause before resuming in the prior direction. During the quiet phase, the price would generally move between an upper and a lower limit. When the reaction highs and lows are connected through two parallel (& horizontal) trend lines, it will give rise to a rectangle pattern. The upper trend line of a rectangle should be made up of at least two equal reaction highs. Similarly, the lower trend line of a rectangle pattern should be drawn using two similar reaction lows.

A rectangle pattern may be construed as an extended flag because of its appearance. Albeit being a continuation pattern, sometimes, a rectangle can result in a trend reversal. Thus, a binary options trader should never assume and enter a trade before the breakout actually happens.

Another important point to remember is that volume, unlike other continuation patterns, may not decline during the formation of a rectangle. However, the volume should increase considerably during the time of breakout.

To confirm a rectangle pattern, the price must close above or below the trend line. It may take several months for the formation of a rectangle pattern. A binary options trader should be fully prepared to enter a trade as soon as the breakout happens. The reason is that the price may retrace or pullback to test the broken support or resistance. The target price is calculated by adding or subtracting the width of the rectangle to the point of price breakout.

Rectangle — bullish breakout structure

Rectangle — bearish breakout structure

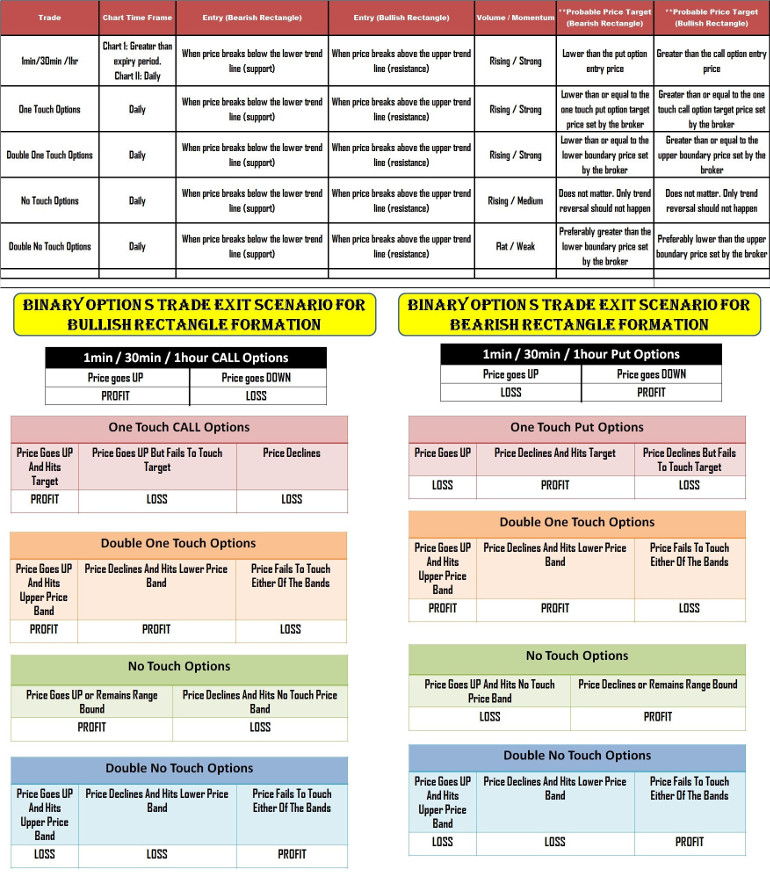

Setting up a binary options trade

1min / 30min / 1hr options

A binary options trader can purchase a contract after the price breaks above or below the rectangle pattern. Being a continuation pattern, a binary options trader should be

On the other hand, a 1min/30min/1hr put option contract should be purchased if the price breaks below the lower trend line. There is a possibility of trend reversal in a rectangle pattern. Thus, a binary options trader should enter a trade only after the break out (price closes above or below the upper or lower trend line) actually happens. The volume should rise during the breakout and the momentum should favor the move.

Lack of volume and weak momentum would result in a reversal and ultimately the contract will expire out of money.

If the prior trend was up then a high risk trader can purchase a 1min /30min/1hr call options when the price bounces of the lower trend line. As long as there is no trend reversal (triggered by unexpected news), the contract will expire in the money.

Similarly, if the prior trend was down then a high risk trader can purchase a 1min/30min/1hr put options when the price retraces after touching the upper trend line. As long as the price remains intact between the upper and lower trend line, the contract will expire in the money. Only a spike arising out of unexpected news can result in a loss.

One touch options

A one touch call option contract can be purchased if the price breaks above (in line with the prior trend) the upper trend line of a rectangle pattern. The volume should be considerably higher during the break out. Additionally, the momentum should remain strong. Apart from these general criteria, the probable target price should be higher than the one touch call option target price set by the broker. Only then a trader should purchase a one touch call option contract.

If the prior trend was down and the price breaks below the lower trend line then a one touch put option can be purchased. Again, in this case, the probable target price should be lower than the one touch put option target price set by the broker. Additionally, volume and momentum scenario should favor a deep decline so that the price will hit the target.

No touch options

As mentioned in several of the continuation patterns, a no touch options is always a relatively safe bet for a trader. The reason is that the price rise or decline need not achieve any particular target price. As long as the price breaks out and stays at or near the same position till expiry, the trade will result in profit. Only a trend reversal aided by a rise in volume and momentum will render the contract expire out of money.

A trader should buy a no touch options contract once the price breaks above the upper trend line or below the lower trend line. However, being a continuation pattern, a trader can remain ready, considering the prior trend, for entering the trade without delay. The volume should increase and the momentum should remain strong during the breakout.

A no touch options contract is very much suited when the price breaks out of the pattern before three months. The reason is that the strength of a price rise (or decline) & the probability of achieving the forecast price depend on the time taken for the formation of the rectangle pattern. Thus, an early break out implies that the target price set by the broker may not be achieved. Under such circumstances, a trader can safely go in for the purchase of a no touch options contract.

If the prior trend was up then a high risk trader can purchase a no touch options contract when the price bounces off the lower trend line. As long as the price boundaries remain intact, the contract will expire in the money. Only a sharp reversal will result in a loss of trade.

If the prior trend was down then a high risk trader can purchase a no touch options contract when the price retraces after touching the upper boundary line. The contract will result in profit as long as the price stays within the pattern. Only heightened volatility caused by unexpected news will make the contract expire out of money.

Double one touch options contract

When there is a scheduled high impact news announcement before the expiry period then a trader can consider purchasing a double one touch options contract. As long as the news favors further price movement in the direction of prior trend or results in sharp trend reversal, the contract will expire in the money.

If the announcement halts the price movement then the contract will expire out of money. Similar to other contracts, the volume and momentum scenario should be considered before purchasing a double one touch options contract.

Double no touch options contract

When the price breaks out of a rectangle pattern without any considerable rise in the volume then a double no touch options contract can be purchased. Another factor to be considered is that there must not be any scheduled high impact news announcements before the expiry period. As long as there is no change in the volatility scenario, the contract will expire in the money.

A rectangle is a simple pattern, which can be traded easily upon breakout. However, a binary options trader should remember that the choice of purchased contract should be based on the time taken for the development of the pattern. Once a trader learns to select the appropriate contract then trading a rectangle pattern would be an easy task to accomplish.

You may also be interested in learning about other chart patterns that can be used to trade binary options: