When Is a Good Time for Early Close?

Professional traders know for sure that no trading strategy is 100% perfect. Success follows those traders who have the innate ability to close loss making trades early, while riding on profits. However, not long ago, a binary options trader had no choice to exit a trade early even after understanding the fact that price movement is not as predicted prior to entering a trade. Even though smart traders resorted to hedging, still, the lack of early closure facility discouraged many traders to operate binary options actively. The brokers were quick to realize the handicap and brought the early close facility, albeit with some restrictions. These often include:

- Stripping down the reward percentage.

- Allowing exits only during certain hours of a day.

- Disallowing exits in high reward option trades.

- Allowing exits only when a certain amount of time passes after entering a trade.

The reason for the restriction is that when a binary options trade is closed early, it is the broker who buys back the contract by acting as a market maker. Thus, to compensate for the decrease in the profit and avoid misuse, certain criteria, mentioned above, should be fulfilled for the early exit icon to get activated.

From a trader’s point of view, frequent use of early exit will ultimately hamper the performance. Thus, the use of early exit facility should be a well thought out decision.

Scenarios for early closure

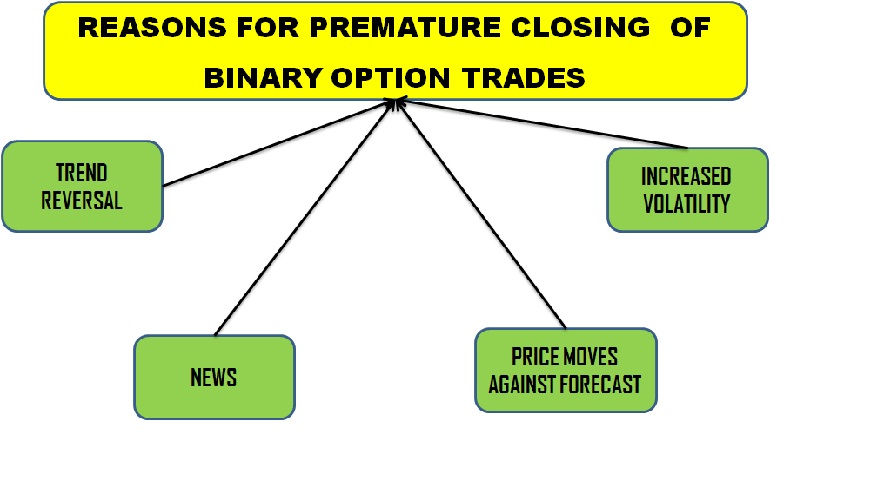

Professionals suggest an early exit only when a trader faces any of the following situations:

- Price moves against the prediction. This is arguably the most important reason for a trader to exit early from a trade. Even a well laid trading strategy can result in a loss. Thus, after taking a position, if a trader feels that price is not moving as anticipated, then the early exit option can be used. Since the trade is

out-of-money , only a portion of the investment will be paid back to the trader. The paid back amount largely depends on the time remaining for expiry and the distance between the price of the underlying asset and the target price. - Trend reversal. When the price of an asset approaches a support or resistance, there may be visual indications of trend reversal through candle patterns such as doji, bearish engulfing or three black crows. In such cases, a binary options trader who is already

in-the-money would like to preserve the capital and realize some profit from the trade. Since innumerable opportunities await a binary options trader, it is wise to exit with a small gain and look for the next setup instead of pondering on a stagnant trade, which might endout-of-money at the last minute. - News. Unexpected news can quickly turn the tides against a trader in binary options trading. Since a difference of one pip decides the end result, it is better to close the position early in case the trader suspects that a particular announcement has the potential to alter the current trend of an underlying asset in a drastic manner. Once the prevailing position is closed early, a new position can be taken after studying the news thoroughly.

- Increase in volatility. Rumors and

geo-political changes can increase the implied volatility of an asset in no time. In such a case, a trader should consider making a quick exit and wait for the dust to settle. It is awell-known fact that unlike traditional options, volatility is an enemy to a binary options trader. Thus, during heightened volatility, early exit would prove highly beneficial to a binary options trader.When volatility changes, a trader should consider making an exit from the following forms of binary option trades:

- One touch and double one touch option. While trading a one touch and double one touch option, a trader can exit the trade early if the implied volatility decreases. A decrease in volatility will restrict the price movement. Thus, it is wiser to exit early and save at least a portion of the investment made in the losing trade. Once an exit is done, the money can be invested in a

no-touch or doubleno-touch option after reviewing the support and resistance levels. No-touch and doubleno-touch option. As discussed above, if the volatility increases suddenly due to some reason or the other, then an early exit can be made from ano-touch and doubleno-touch options trade. Since a rise in volatility increases the range of price movement, the probability of losing the trade increases. Thus, it is smarter to exit the trade early andre-invest the capital in a one touch or double one touch option contract after looking at the entire scenario once again.

- One touch and double one touch option. While trading a one touch and double one touch option, a trader can exit the trade early if the implied volatility decreases. A decrease in volatility will restrict the price movement. Thus, it is wiser to exit early and save at least a portion of the investment made in the losing trade. Once an exit is done, the money can be invested in a

Merits

- Early exit facility allows a trader to keep the draw down rate lower. This is vital for trading in general.

- Keeps the morale of a trader high.

- Opens up more opportunities for

digital-vanilla combo trades.

Demerits

- Tough rules for early exit.

The provision of an early exit undoubtedly benefits smart binary options traders. However, a trader should think twice before using the facility. Frequent use of the facility puts a serious question mark on the strategy applied to trade binary options. You can use our list of brokers with early close option to find a broker that fits your requirements and has the feature.