How to Analyze Performance of Binary Trading Strategy

To succeed in binary options trading, a trader must have a successful trading strategy. There are plenty of strategies available for free in the internet. At the outset, all strategies look great. However, not every strategy suits a trader’s risk profile. Thus, it becomes quite important for a trader to familiarize the strategy

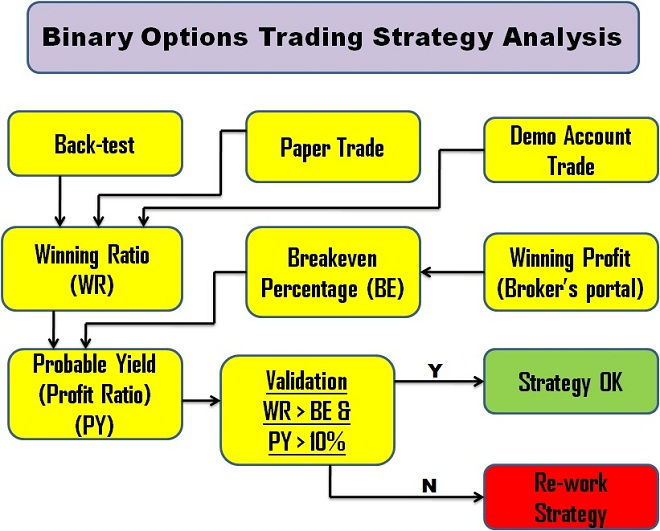

The following methods will enable a trader to validate a trading strategy in detail.

Back-testing

It is the process of applying the trading strategy to a stream of historical price data. Even though the conditions are not similar, it enables a trader to understand how the strategy will work in a real trading scenario. Ineffective strategies can be quickly identified thereby avoiding wastage of time and money.

Paper trade

This is the age old method of evaluating a trading strategy. The process involves writing down the entries and exits on a piece of paper whenever a trading opportunity arises on line with the developed binary options trading strategy. The process is continued for at least a month to ensure that the strategy is applied in different market conditions. At the end of the month, a detailed analysis of the trades is done, as discussed below, to decide whether the strategy is suitable for employment in a real trading account.

Demo account trade

This is usually the final step before implementing a strategy on a real account. A demo account provides a replica of a real trading environment. A trader will be able to understand and access all the features available. The account is loaded usually with virtual currency for the traders to test their strategies without any risk. A trader should try the strategy in different assets and expiry time so that a detailed assessment can be made at the end. The strategy should also be tested during different trading sessions (Asian, European and US market). We provide a list of binary options brokers that have demo accounts if you need one for testing.

Strategy viability assessment

Once the data pertaining to many trades are collected through one or more of the methods discussed above, a trader should test the performance of the strategy as follows below.

To assess a binary options trading strategy in detail, the breakeven percentage should be calculated at first. It is a

On the other hand, a losing trade simply means that a trader will lose the entire capital locked for that trade. In a case where the broker offers a rebate, as much as 15% is paid back to the client.

Thus, it becomes important to understand the breakeven percentage required to succeed in binary options trading. The breakeven percentage can be calculated as follows:

Breakeven (BE) = Out of money percentage / (Out of money percentage + In the money percentage)

Let us assume that a broker offers 80% on a winning trade and 0% on a losing trade. The breakeven percentage can be calculated as follows:

BE = 100 / (100 + 80) = 0.5555 or 55.55%.

Thus a trader should win at least 56 trades out of every entries made to prevent capital erosion.

If the percentage offered on winning and losing trades are 70% and 15% respectively then:

BE = (100 — 15) / (100 — 15 + 70) = 85/155 = 54.8%

The data collected from the paper or demo account trades should be used to calculate the winning ratio.

If a total of 65 trades had resulted in profit out of 100 trades taken then the winning ratio is

This value should be greater than the break even percentage. Meta Trader’s

The trading strategy is considered successful if its winning ratio is higher than the break even ratio.

Now, the probable yield from the strategy can be calculated as follows:

Probable yield or profit ratio (PY) = Winning ratio – Breakeven percentage (BE)

Let us assume that the strategy has a winning ratio of 65% and BE of 55.55%. Then:

Thus, a trader with PY of 9.45% and employing $20 per trade in a broker’s platform having a breakeven of 55.55% will have the following amount in hand after 100 trades:

100 * 9.45% * $20 = $189

The total traded value would be 100 * 20 = $2,000.

For any given trading strategy, the winning ratio should be higher than the breakeven ratio.

Similarly, a trading strategy is considered to be efficient as long as it has a high PY ratio.

Using the data from

Before a trader begins to trade on a real account, it is a must to have a precise idea about the metrics mentioned above. Only then a trader will not feel jittery when he faces an occasional series of losses.