Advantages of Trading Binary Options via Exchange

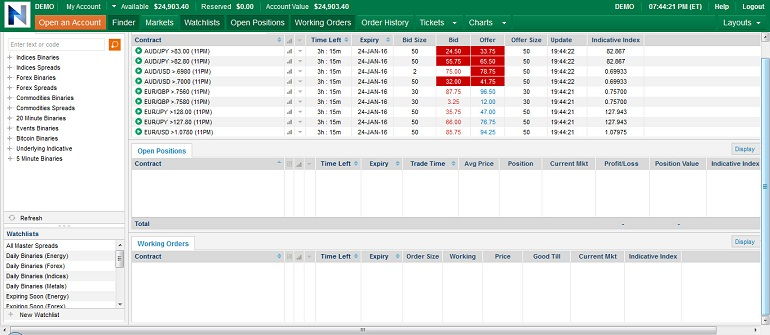

Binary option is arguably the simplest form of a derivative contract available for trading. Thus, it continues to lure established traders and newcomers to the financial markets. However, barring AMEX (FRO’s), NADEX and VIX binaries (Chicago Board Option Exchange), all other binary option platforms typically are OTC (

Price transparency

There is absolute transparency while trading binary options through a regulated exchange. The market forces and not the broker, as in the case of an OTC trading, determine the price at which an option contract is traded. This allows complete price discovery as per the efficient market hypothesis. The exchange only facilitates transactions between two independent parties and has no involvement in the price discovery. A regulated exchange (Nadex for example) will also send a settlement contract with time and sales data to confirm the trades.

No house advantage

In the case of OTC, the house or broker takes the other side of the trade. So, there is no guarantee of an unbiased trading environment. On the other hand, a regulated exchange will not participate in trading activities. It will simply match a buyer and seller in an unbiased manner. Thus, the result of a trade entirely depends on the parties taking respective positions.

Low entry barrier

Most of the OTC binary trading platforms demand a minimum deposit of $250 to commence trading. Furthermore, the minimum deposit and conditions pertaining to bonus or any other promotions can be changed at will. On the other hand, the minimum deposit will be much lower in the case of a regulated exchange. For example, Nadex requires only $250 as the minimum deposit to open a real trading account and start trading. Furthermore, a regulated exchange will never participate in any kind of promotions, which will force a trader to complete a certain trading volume before initiating a withdrawal request.

Capped fees

A successful trade in an OTC platform will result in a maximum yield of 92%. On the contrary, a successful binary option trade in a regulated exchange will result in a profit of 100% minus the charges, which will have a ceiling. For example, Nadex charges a minimum of $0.90 and a maximum of $9 per contract. Thus, as the number of contracts or units or the investment value increases, the gain from a successful trade in such a platform would be substantially higher than that achieved from an OTC platform.

Easy to open demo accounts

Most of the

Moreover, a regulated exchange will also send out contracts to the registered email address even when a virtual trade is executed. This enables a trader to easily review the performance.

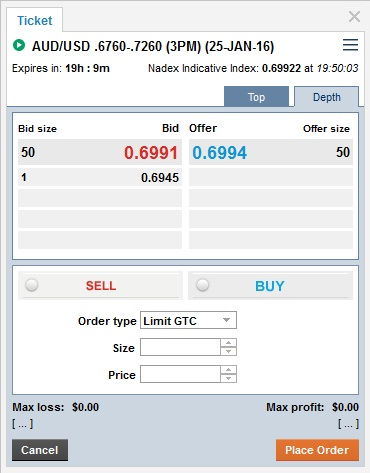

GTC (good-till-cancelled ) order facility

A majority of the OTC platforms doe not offer a limit or

Tradable at will

A trader can enter and exit a binary options contract at his will in a regulated exchange. This provides a great advantage in a situation where there is an unexpected trend reversal. Furthermore, in a regulated exchange, there will be virtually no restrictions as far as trading volume is concerned. It is not so in the case of OTC brokers. Additionally, a regulated exchange offers contracts with multiple expiry times. For example, the Nadex platform offers expiry time ranging from five minutes to eight hours.

If a trader believes that the trend is changing again, he can

Facilitates multiple strategies

The binary options traded in an exchange are structurally different. Additionally, an exit from a trade at any point of time is easy (provided there is a

Hedging

Binary options are one of the most powerful financial vehicles available to hedge the risk of an investment portfolio. In this regard, a regulated exchange usually offers a wide range of assets (currencies, commodities, indices, bitcoin and even economic events such as US Federal Reserve interest rate announcements) with short and

Safety of funds

To any trader, safety of funds is one of the primary requirements to sign up with a broker. Trading with a regulated exchange allows peace of mind to a trader. Again, for example, the funds of Nadex members are held in segregated bank accounts in accordance with the CFTC (Commodities Futures Trading Commission) regulations. A regulated exchange will never initiate speculative positions in the market. Thus, there will never be any deposit or withdrawal issues. Moreover, all withdrawal requests are cleared within a prescribed time frame. On the other hand, dealing with an unregulated binary options broker may result in withdrawal problems. Additionally, it is illegal for a US resident to trade binary options through a broker unregistered with the US regulatory bodies. This will add up to the anxiety while trading with an unregulated broker.

Fixed rules

A regulated binary options exchange will never customize rules or alter it often or without a proper announcement. It remains the same for everyone. In a case where there is a need to change any rule, the exchange will issue a prior notice through their website and also via email. On the other hand, without any prior notice, to serve their vested interests, an OTC broker can change any condition related to trading.

Furthermore, at any time, a customer can voice his concern by launching a complaint to the organization, which governs the regulated exchange. For example, in the case of Nadex, a trader can register a formal complaint with the CFTC, which will certainly look into the matter at the earliest. The process is difficult and lengthy in the case of an OTC binary options broker.

Conclusion

To trade successfully, a trader should remain focused. Dealing with an exchange rather than a pure dealing desk will enable a trader to avoid distractions and concentrate on making consistent returns from multiple markets.