Trading Binary Options with Currency Pairs Correlation

Correlation is a statistical measure of the relationship between any two assets (currency pairs, commodities, stocks, etc.). The correlation between any two currency pairs in a Forex market can be either positive or negative. If two currency pairs share a positive (direct) correlation between them, then the direction of price movement will be the same at any given point of time. Likewise, if two currency pairs share a negative (inverse) correlation between them, then the direction of price movement will be mutually opposite at any given time. A trader should also remember that in most cases, no correlation exists between two currency pairs.

A trader will be able to take two trades at the same time by monitoring the price movement of one currency pair, which shares a correlation with another. So far, we had spoken about trading currencies in

Positive and negative correlation coefficient

Two currency pairs with a positive correlation may move in the same direction. However, the quantum of movement may not be the same. For example, the EUR/USD and GBP/USD pairs share a positive correlation. This means that when the EUR/USD pair is trending upwards, the GBP/USD pair will also be in an uptrend. However, for every pip movement seen in the EUR/USD pair, there may not be a pip movement in the GBP/USD pair. If the GBP/USD pair moves by one pip for every pip movement seen in the EUR/USD pair then both currency pairs are said to have a perfectly positive correlation coefficient of +1. In percentage terms, it is expressed as 100%.

Similarly, the EUR/USD pair shares a negative (inverse) correlation with the USD/CHF pair. This means that if the EUR/USD pair is an uptrend, then the USD/CHF pair would be in a downtrend. However, for every pip movement seen in the EUR/USD pair, there may not be a pip movement in the USD/CHF pair. If the USD/CHF pair moves down by one pip for every upward pip movement seen in the EUR/USD pair, then both currency pairs are said to have a perfectly negative correlation coefficient of -1. In percentage terms, it is expressed as -100%.

Now, to apply correlation between two assets successfully in binary trading, a trader should know the following details:

- Nature of correlation (positive or negative)

- Correlation percentage (between +100 and -100)

Authentic correlation data sources

Fortunately, a binary trader need not go through the difficulties of calculating the correlation between various currency pairs, commodities and precious metals. Most of the finance related websites offer them for free. In this regard, there are two reputed sources of information that a trader can use to his advantage: Oanda and Mataf.

Oanda

Oanda enables a trader to study correlation between major currency pairs, exotics, metals, indices, commodities and even US/UK Treasuries. The checkboxes provided next to the asset categories enable a trader to narrow down the selection. Once the list is narrowed, a reference currency (or any other asset), indicated by a green underline, can be selected by

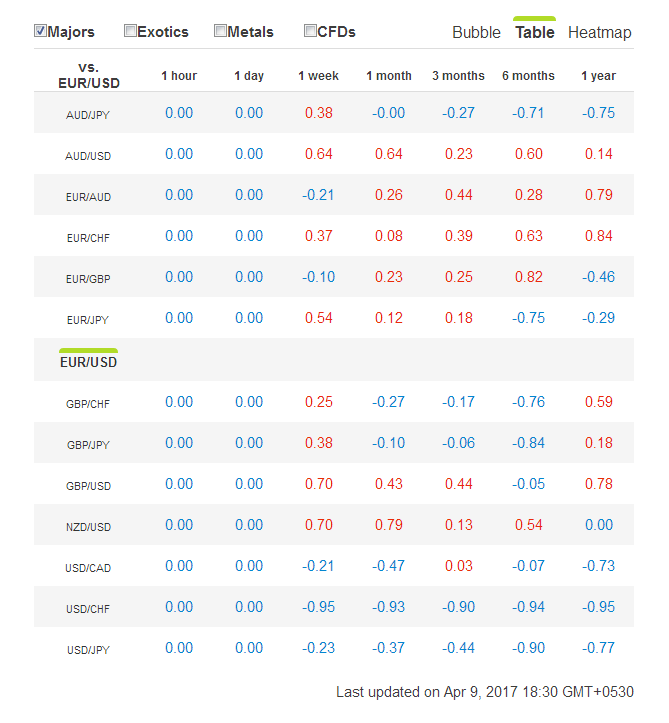

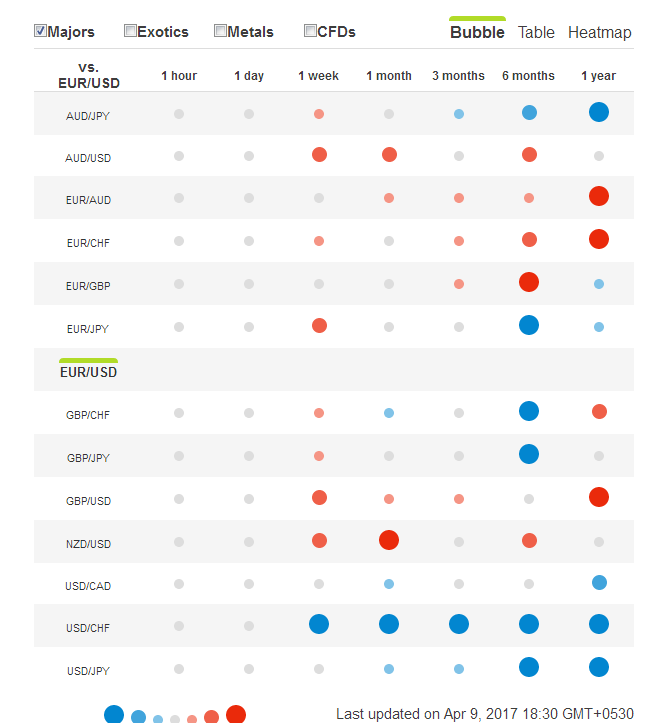

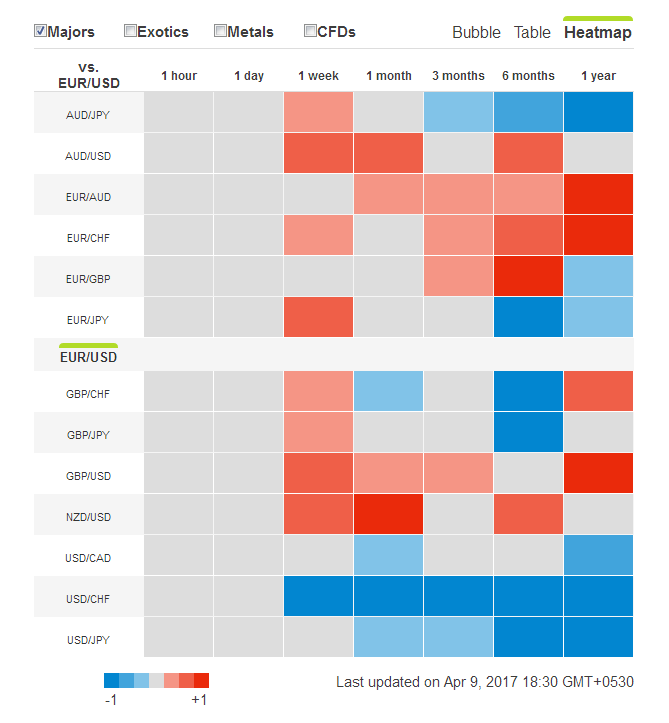

A trader can choose a standard table format or other forms of visual presentations (bubble, heatmap) to study the correlation, as shown in the images below. A detailed popup message indicating the level of correlation is shown when the mouse pointer is moved over the bubble or heatmap. The greater the bubble size, the higher is the correlation. Dark red and blue colors indicate the strongest positive and negative correlation, respectively, between currency pairs (or any other assets). Grey color indicates lack of correlation.

We chose to find the EUR/USD pair’s correlation with its major rivals through Oanda.com and received the details (table, bubble, and heatmap) as shown below.

Mataf

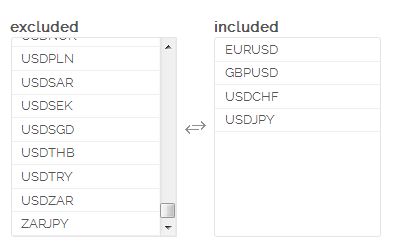

The financial website Matef.net visually displays correlation as a graph instead of a bubble or heatmap. It is needless to say that the table format is readily available as well. Two tabular columns (named ‘excluded’ and ‘included’) are provided for the selection of currency pairs. Notably, only the most common currency pairs are offered for study.

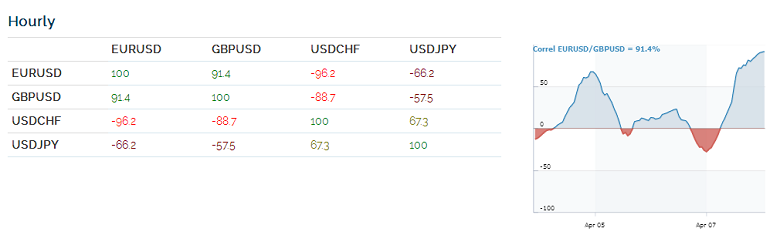

Once the currency pairs are selected, as shown below, the page displays the correlation coefficient in the form of a table along with a graph. The correlation data is provided for a period of 5 minutes, one hour, four hour, and one day. The graph enables a trader to identify the periods of increasing and decreasing correlation even with a given timeframe. It would be useful for a binary trader to time the entry.

The first thing a trader can notice is that the correlation between two currency pairs is not the same across all the timeframes. For example, the Oanda’s correlation map shows high positive correlation between the EUR/USD pair and NZD/USD pair in a 1-month timeframe. However, in a 3-month timeframe, the correlation remains neutral (no correlation).

As it can be seen in Oanda’s table, in a weekly timeframe, the EUR/USD pair shares a positive correlation with the GBP/USD pair, and a negative correlation with the USD/CHF and USD/JPY pairs. However, the EUR/USD shares a higher negative correlation of 95% with the USD/CHF pair, compared with only 23% negative correlation with the USD/JPY pair. This means that while betting on an uptrend in the EUR/USD pair, a binary trader should choose to bet on a downtrend in the USD/CHF pair, rather on the USD/JPY pair. This would increase the probability of success in the trade as long as the contract expiry period is one hour. It should be remembered that correlation percentage between any two pairs is not a constant. So, a binary trader should regularly keep himself updated on the changes in the correlation ratio.

Using correlation in trading

After collecting correlation details between different currency pairs, commodities, and metals, a binary trader can open trades as described further.

Low positive correlation

A binary trader should first look for two currency pairs with low positive correlation in a timeframe less than or equal to one hour. Once the currency pairs are selected, a trade should be opened in the simplest of option contracts, i.e. a call or put option (or their equivalent). Even though both currency pairs may move in the same direction, the extent of movement will not be the same since the currency pairs have a low positive correlation. Thus, trading a

Once an uptrend is confirmed, a trader should purchase a call option in both the currency pairs. This means that a trader who has identified a low positive correlation between two currency pairs in a 1-hour timeframe should choose to trade contracts which expire in an hour and not later. If the trader spots a downtrend, then a put option should be bought in both the currency pairs as described above. Again, the expiry period of the option should match the correlation timeframe.

High positive correlation

To begin with, a binary trader should choose two currency pairs with high positive correlation in a timeframe of not less than a day. Once that is done, the trader should select a contract which offers a greater return on investment. A

Low negative correlation

In this case, two currency pairs which have a low negative correlation in a timeframe of one hour should be selected. Once an uptrend is identified in a currency pair, a call option should be bought. Simultaneously, a put option should be bought in the currency pair which shares a low negative correlation with the currency pair in reference. It is better to stick with simple contracts (call and put option combo) having

High negative correlation

It is similar to trading currency pairs with a high positive correlation. Initially, two currency pairs with a high negative correlation in a timeframe not less than a day should be selected. This is followed by the selection of an option contract which offers high returns. The contract should be preferably traded during major economic news releases. Once an uptrend is confirmed in a currency pair, a

A binary trader can also select a

Once a binary trader learns to set up trades based on the basic techniques explained above, complex trades can be constructed to generate returns from multiple trades by simply concentrating on the price movement of a single currency pair. Choosing a broker with multiple currency pairs available is recommended if you want to benefit from correlation trading.