Price Spreads in Binary Trading

Aside from binary options brokers, charts, and trading strategies, price spreads is one of the most important factors that need to be considered when trading. Most new traders fall into this trap because they think that price spreads is a complicated thing. On the contrary, it is a simple knowledge that all binary options traders need to look out for. When the consistency of a price spread is known, a more accurate prediction can be made regarding the closing price of a trade, and a more informed decision can be derived from this prediction.

Price spread is simply the difference between the buying and the asking price of a security or asset. For traditional trading, i.e.

Sometimes, the price of an asset in the binary options broker is different from the price in the charting platform. The reason behind the price difference is that these two systems pull their data from different servers. Different servers may have different price information this is why we see a difference in prices. But the difference of the price can be deemed negligible if there is constancy in the price spread. However, if the difference of the price varies at unknown time periods, then that is a sign of a bad binary options broker. Let’s see an example to illustrate this logic. But first, let us take a look on how much difference we are talking about here.

Pips

In binary options trading, differences in price levels are measured in pips. A pip, short for

For example, the smallest difference that the USD/CAD currency pair can make is $0.0001, or one basis point. The smallest move in a currency does not always need to be equal to one basis point, but this is generally the case with most currency pairs.

Consistent Price Spread

Let us compare the price from a binary options broker and a charting platform. The charting scenario for the binary options broker will be shown on the left pane in the diagrams while the the chart found on the charting platform will be shown on the right. We will assume that the bars represent 5 minute candles and the trades expire in 15 minutes.

Let’s say on the chart of the binary options broker, a candle opens as such:

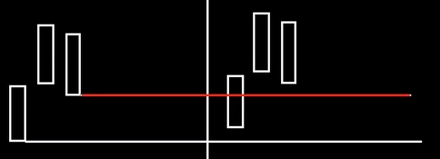

Let us draw a line to demarcate the opening price:

Now, your charting platform may show that the opening price is one pip higher, such as this:

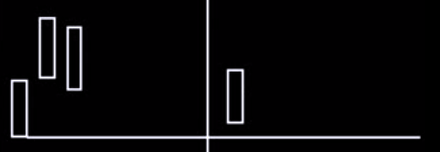

For the 15 minute trade, the chart in the binary options broker may look like this:

Your charting platform can show a similar pattern, but still following the price spread that it had when the trade opened:

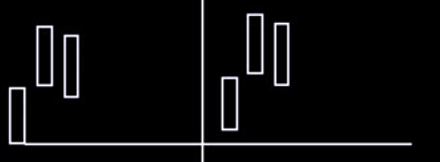

If we draw another demarcation line to denote the closing of the trade, we can see that the difference of the opening price between the binary options broker and the charting platform is the same with its closing:

As we can see, the expiry price shown in in the left is lower than the expiry price shown on the right. The difference of the expiry prices is assumed to be equal to the difference of the opening prices between the two charts, where the binary options broker chart opened lower that the one that your charting platform shows. As long as the price spread is constant, then you should win no matter what. The price spread in this situation is not relevant.

In this instance, the binary options trader may not care about the price spread. The new trader may be trading for months without noticing this, but as long as the charts in the binary options broker and the preferred charting platform show a constant price difference, then the trader should have no problem with this. Again, the price may be varying, but the variation of the price should be constant.

Inconsistent Price Spread

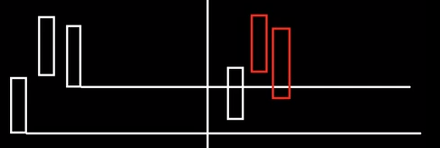

From the same example above, what if the price spread is not constant? In the figure below, we still assume the 5 minute candles and the 15 minute trades we set earlier. But now, the spreads are different:

As we can see from the figure above, the price on the right opened higher than the opening price on the left. If the spread is constant, all prices on the right should open higher. But now, the second 5 minute candle on the right opened lower than the opening of the second 5 minute candle on the left. This shows an inconsistent price spread. In this case, the binary options broker should worry and should disregard the use of the broker altogether.

Worse is what happens to the third 5 minute candle. As we can see, the entire 15 minute trade closed lower on the charting platform than the expiry price on binary options broker. This can now pose a problem especially if the price difference leads to a point where you actually end up

But, since we learned that binary options brokers and charting platforms all take their data from different servers, there will always be a difference. In this case, the binary options trader needs to choose a broker who has an overall constancy. There might be a price difference of fractions of a pip for every period of the trade, but the overall consistency of the binary options broker should be considered carefully. We do not recommend those volatile brokers who have a price spread of say 2 pips at one time and 3 or 4 on another.

As a binary options trader, you don’t need to worry about finding the right broker that provides consistency. We have compiled the list of the best companies so that you can choose safely and start trading smartly.