How Binary Traders Can Benefit from Fed Rate Expectations

The financial market participants are well aware of the fact that geopolitical and economic news is primarily responsible for the changes in the value of a traded security. Based on the nature of news, traders usually take a long or short position in a

An increase or decrease in the interest rates announced by the central bank of a country will immediately impact the currency value of the corresponding country. However, the interest rate decision announced by the Federal Reserve, the central bank of the USA, will create huge effect in the value of almost all the

Fed rate and its impact on various currencies

The federal funds rate is the interest rate used by banks to lend among themselves (trade balances held at the Federal Reserve) on an uncollateralized basis. The FOMC (Federal Open Market Committee), which is a branch of the US Federal Reserve, determines the course of monetary policy and makes discrete adjustments to its target for the Fed funds rate. The Fed achieves its objective by buying or selling government securities. The FOMC’s announcement to increase, decrease or leave the interest rates unchanged, stirs the financial markets as a whole and the currency market in particular.

The financial markets build its opinion on Fed rates usually based on how healthy the US and global economy is. Low unemployment rates, high wage levels and low inflation data generally inspire a rate hike expectation. However, the FOMC’s decision may or may not reflect the opinion of the market. The reason is that the FOMC members may give more priority to certain issues (for example, the Shanghai market turmoil), which the market may temporarily discard. This will ultimately result in a decision that can sometimes surprise the market as a whole.

Fed funds rate futures

The traders and analysts always look upon the Federal funds futures, traded on CME, for an indication of whether the market anticipates a change in the Fed rates. The reason is that futures market participants, before making contingent commitments, will always make a detailed study of those factors which influences the decision of the FOMC. Ultimately, the Fed will target the funds rate and the overnight rates will stay close to the Fed’s target. Thus, the Fed funds futures rate logically reflects the market’s anticipation of the course of the Fed Reserve.

The Fed funds futures rate is quoted on an index basis. So, to arrive at the market’s expectation of the Fed funds rate, the Fed funds futures rate is deducted from 100. For example, if the Fed funds futures rate is 99 then the market’s expectation of the Fed funds rate is 1% (100–99). This means that an increase in the Fed funds futures rate indicates a corresponding decrease in the market’s expectation of the Fed rate. Each Fed funds futures (ZQ) contract is for $5 million with a 30-day expiry (last business day of the delivery month) period. At any point of time 36 contracts (starting from the current month) is being traded.

Still, it is not an easy task to gauge the market’s Fed rate expectation based on the Fed funds futures. The reason is that large banks which are highly active in the spot market for Federal funds also use the Federal funds futures market to hedge against the spot market rate increases. This ultimately builds a premium in the futures funds rate as well. To put it simpler, there will always be a spread between the average Fed funds rates and the Fed funds futures rates. Additionally, the average Fed funds rates are also subject to settlement Wednesdays effect (final day of the reserve maintenance period when the funds rate will sharply rise or decline depending on whether the reserves are scarce or abundant). All these factors contribute to the complexities in the extracting the market’s expectation from the Fed funds futures rates.

Thus, professionals always suggest inexperienced binary options traders (and other financial market participants alike) to refer to the opinion poll conducted (among leading economists) by the Bloomberg website for guidance. Additionally, a binary options trader should remember that largest price swings happen when the interest rates of two countries move in the opposite direction.

Decision impact

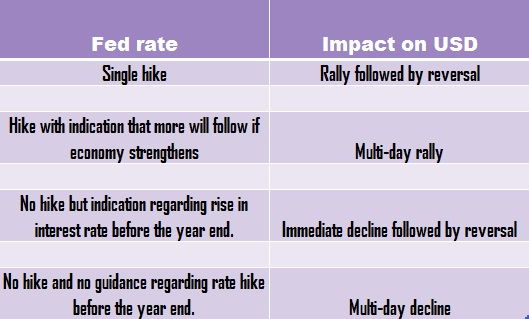

Theoretically, the impact of the FOMC decision on the US dollar will be as presented in the tabular column below:

However, temporarily, the US dollar may not react as expected even though the market will align itself along the fundamentals sooner or later. This is where the psychological factors such as the overall market sentiment come to play. There may also be a situation where the market would have already priced in the expectation. Under such circumstances, the market may

Similarly, a rate hike generally reduces the capital expenditure of the domestic companies, which may lead to decline in demand for equities and thus the currency. Thus, stock markets may react negatively to a rate hike. In the long run, as the US dollar starts flowing back into the US economy the indices would recover. Thus, it would be better for a binary options trader to think twice before taking any positions.

Trading Fed rate expectations

A binary option trader can setup the following trades based on the Fed rate expectations and benefit from them.

Short-term call/put trades (60 seconds, 30 minutes, hour)

Single rate hike expectation

If a binary options trader expects a single rate hike with nothing more to follow in that year, then a call option contract can be bought in those currency pairs (or assets with direct correlation with the US dollar) that have the US dollar as the base currency. At the same time, a binary options trader can also purchase put option contracts on those currencies or assets which have an inverse correlation (as shown in the tabular column above) with the US dollar and are near the major resistance.

Multiple rate hikes expectation

Similar to the above trade, a binary options trader can purchase call option contracts in those currency pairs (or assets with direct correlation with the US dollar) that have the US dollar as the base currency. Since the rally may extend beyond a single day, a binary option trader can use the opportunity to enter fresh trades at regular intervals to squeeze out maximum profits. A put option contract can be purchased in those currency pairs or assets that have an inverse correlation with the US dollar. Again, systematic trades can be done at regular intervals to capitalize on the probable

No rate hike expectation but with guidance

If a trader expects only guidance but no rate hike expectation, then a put option contract can be bought on those pairs that have the US dollar as the base currency. A trader should be cautious to enter only near the resistance as the decline will not last longer. Alternatively, a call option contract can be bought on those currencies or assets that have an inverse correlation with the US dollar. In such cases, an entry near the support is ideal as the uptrend will last only for a short span of time.

No rate hike expectation and no guidance

If a binary options trader does not expect any rate hike or guidance, then a put option contract can be bought on those pairs (or assets with direct correlation with the US dollar) that have the US dollar as the base currency. Additionally, a trader can enter new trades at regular intervals to capitalize on the probable

One-touch option trades

Single rate hike expectation

A

Multiple rate hikes expectation

If a binary options trader expects multiple rate hikes then the trades mentioned in the above paragraph can be executed. Additionally, more trades can be entered at regular intervals based on the expectation that the rally on US dollar will continue for multiple days. However, it should be remembered that trades are to be taken only after checking out the distance between the prevailing price and the

No rate hike expectation but with guidance

If a trader expects no rate hike expectation but only guidance, then a

No rate hike expectation and no guidance

When a binary options trader expects neither a rate hike expectation nor guidance, then a

No-touch option trades

Single rate hike expectation

If a binary options trader expects only a single Fed rate hike for the year then a

Multiple rate hikes expectations

If a binary options trader expects multiple rate hikes for the year, then

No rate hike expectation but with guidance

If a binary options trader expects no rate hikes and only guidance for the current year, then a

No rate hike expectation and no guidance

When a binary options trader does not expect a Fed rate hike or guidance, then a

Double one-touch option (range) trades

Single rate hike expectation

If a binary options trader expects a single Fed rate hike for the year, then a double

Multiple rate hike expectation

If a binary options trader expects a multiple Fed rate hike for the year then a double

No rate hike expectation but with guidance

If a binary options trader does not expect any rate hike but only guidance, then a double

No rate hike expectation and no guidance

A double

Double no-touch option trades

Single rate hike expectation

A double

Multiple rate hike expectation

Again, in this case, the upper band of the double

No rate hike but with guidance

A double

No rate hike and no guidance

If a trader expects no rate hike and no guidance, then it is better to avoid entering a double

Conclusion

Even though it looks quite simple trading the Fed rate expectations demand a lot of experience. Thus, a binary options trader should certainly practice on a demo account at least for two or three times before setting up the trade on a real account. For your information, FOMC meetings are usually held eight times per year.