Choose the Right Binary Option Expiration Period

There are many benefits to binary options trading over traditional stocks or Forex trading. Binary options are unrivaled in their simplicity. They are easy to understand and execute, even for beginners. Some types of options even provide you with amazing opportunities you will find nowhere else. With Range trades for example, you can make money in flat markets.

But one area where binary options are not superior to traditional forms of trading is where expiry periods are concerned. This is something you will figure out quickly when you start trading. You are given a finite selection of trade opportunities and expiry periods. If you pick the wrong expiry time, even with a great trade setup, you will lose.

So, how do you choose the best expiration period for your trades? That is the subject we will explore in this article. But first, I will go over expiry basics with you just in case you are a complete newbie.

What Is a Binary Options Expiration Period?

Let’s take an example of a standard High/Low trade. With a High/Low trade, you are essentially being asked a question about a financial asset, which could be a commodity, currency, stock, or index. Let’s say the asset is GBP/JPY.

At (expiry time), will the price of GBP/JPY be higher or lower than (price)?

You answer that question by choosing High or Low (sometimes termed Call or Put).

If when the trade expires you were correct, and the asset is priced as you anticipated, you would win. Otherwise, you would lose.

So, if you picked High for GBP/JPY, and GBP/JPY was trading above the specified price when the trade expired, you would win. If it was trading below it, you would lose your investment.

How Is This Different from Traditional Forms of Trading?

Let’s consider how Forex works. Imagine we are again talking about GBP/JPY, and you still have reason to believe that its price is going to rise.

With a regular FX trade, you would use a market order to buy immediately, or a limit order to buy when price hits a certain level. You would then be in the trade.

You can then sit around in front of your computer and exit the trade manually whenever you want, or you can set up a

Limitations of Binary Trading Expiry Times

You should now start to see why the expiry time system used in binary trading is restrictive. With traditional forms of trading, you can exit your trade whenever you want. That means you can be entirely strategic about it. If necessary, you can do it on the spot.

But with binary options trading, that is not always possible. The expiry time you picked at the start of the trade is the one you are stuck with (there are some exceptions — see the section on early close below).

This can make it a challenge to profit for multiple reasons.

- First of all, unless you are trading on an exchange, the broker is taking the opposite side of every trade you make. You are playing against the house. It is therefore not in your broker’s interest that you win. So, the entries and expiry times (exits) offered to you will play in your broker’s favor, not yours.

- Some systems are reliant upon highly specific exit strategies. You may have a great system which is impossible to put into practice because none of the expiry times offered are a fit for the exit strategies you need to adopt to be profitable.

- There are also systems that depend on your ability to close out your trades at a moment’s notice. If you cannot exercise this control, you cannot profit.

- Backtesting can be confusing. After all, while you are testing trade ideas on historical charts, you have no way to know what expiry times would have been offered to you. So, you cannot say with certainty whether your system will work in real life.

So how can you tackle these choices and choose profitable expiry times? Following are four suggestions.

Start by Developing a Strategy

No matter what, the first thing you need is some kind of strategy to trade with. You need a system which gives you entry rules. With traditional FX, it could be said that your system needs to include exit rules as well, but as you do not have total control over your exit strategy with binary options, let’s say exit guidelines.

Taking an example, let’s say you are going with price action, and you will be trading pinbars and inside bars. You must start by learning how to recognize those formations. Then you need to come up with a rule for how and when you will enter trades.

Pick Expiry Times Appropriate for Your Timeframe

The next recommendation is that you go through and backtest your strategy as you would trade it for traditional FX. Go through old charts and note down trade entries you would take as well as the exits you would ideally make. If the results are profitable, you have a system that may potentially work for binary options as well.

Now you should have a pretty good idea what an ideal expiry time looks like for your typical trade. If you have a broker that allows you to set customized expiry times, use what you have learned to do so. Just think of it like setting a

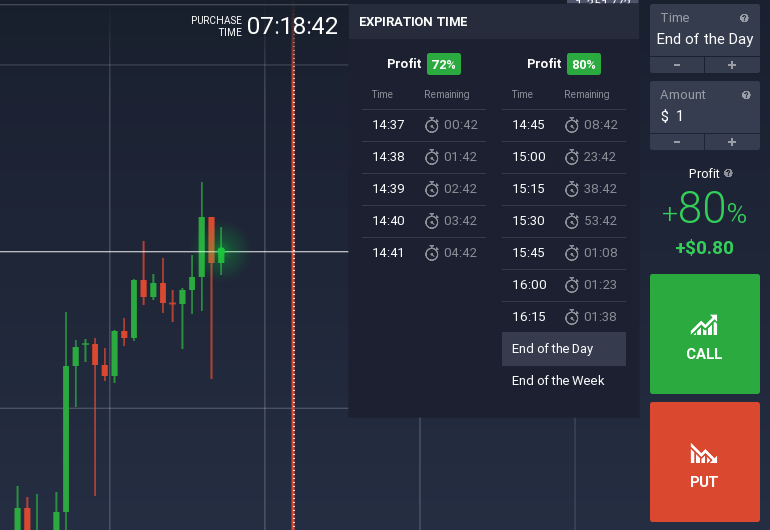

Most binary brokers do not allow this however. They will only offer you a certain selection of expiry times. It is up to you to pick the best one — or skip the trade. For example, the screenshot below (from IQ Option platform) demonstrates that the range of expiry periods is quite limited even with brokers that offer a rather flexible choice:

If there is an expiry time available near where you would set a

If there is not one, think about timeframes. Is there an expiry time which may still be appropriate given your trade?

If you have been testing price action strategies on the 1-hour chart, for example, and most of your profitable trades during testing spanned several hours or longer, it makes no sense to pick an expiry time 20 minutes in the future, or several months from now. But if there is something within a few hours, that may be a viable choice.

Likewise, if you are a position trader banking on some kind of

And if you are using a strategy for scalping, an expiry time of even 10 or 20 minutes might be too much. You may do better with 60-second trades.

A quick note about 60-second trades: If you can profit off of them, by all means, do so. But if you are a newbie, it is important to recognize that this timeframe is incredibly volatile.

So, if you are still in the stages of choosing a strategy, go with one that will naturally steer you in the direction of longer expiration periods. You will be dealing with less volatility. Less volatility means less uncertainty, which in turn means a reduction in risk.

Definitely Do Some Demo Testing

The next tip for choosing appropriate expiration periods is to make sure that you demo test before you go live. As was mentioned before, there are some questions about exiting trades which you cannot reliably answer while backtesting.

But with demo testing, you can find out whether your strategies will work in real life with

Once you do start demo testing, you may discover one of several things.

Either your trades will work out as planned, because the expiry times you need are readily available…

Or…

Your plan will not work out at all, because the expiry periods you need are rarely or never available…

Or…

Your system will sort ofwork. The expiry times may not always be ideal, but you may discover with some tweaking that you can get the results you need.

You cannot overestimate the importance of this step. There is no other

Use Early Close

One of the more insightful conversations I ever had with a binary options broker concerned the early close feature which some websites offer.

Early close allows you to exit a binary options trade you are in before it expires.

Different sites have different restrictions on this tool. A few sites allow you to use early close anytime. But most have some kind of limitations on it. For example:

- You might only be able to early close while you are profitable (for a partial profit).

- You might only be able to early close while you are unprofitable (for a partial loss).

- You might not be able to exit a trade during the last 5 minutes before it expires (or some other length of time).

You will need to check your broker’s resources to find out how early close works on your trading site.

Coming back to the conversation I mentioned, the owner of a binary site once told me that the single biggest mistake that traders on her site made was not using the early close feature.

She told me the vast majority of her customers were losing money, and the few that were profitable made great use of early close to minimize and avoid losses.

So, if it makes sense with your exit strategy, do make use of this tool. Since you cannot customize your expiry times on most binary sites, early close is often indispensable when it comes to getting the exit time you need.

There is also a tool called rollover to extend a trade past the expiry time, but be advised to approach it with caution. Usually you are asked to increase your stake in order to extend your expiration time.

Conclusion

Exiting trades profitably with binary options is a challenge compared to the traditional forms of trading, but definitely not impossible. Now you know all about how expiry times work in binary options trading, and you are familiar with the obstacles involved with choosing profitable expiration periods. But with some testing and creativity, you should be able to pick binary options expiry periods that work for you.