Binary Options Risk Management 101

There are a few things you need to trade binary options profitably: starting capital, a trading method, a trustworthy broker, and a system for risk management.

This post will serve as your comprehensive 101 guide to risk management. As you will discover, this is a pretty straightforward topic. By the time you finish reading through this guide, you will know what does and does not work for managing your risk when trading binary options.

What is risk management?

Risk management refers to the approach you take for controlling your risk exposure when trading binary options.

Every trade you take entails an element of risk; no matter how good your trading system is, you can still lose trades.

The way you mitigate your risk is to set position sizes that keep your losses within acceptable margins.

Basically, you do not want a few bad trades to wipe out your account. By sizing your risk appropriately, you are more likely to survive periods of drawdown.

Key point: Risk management is the process of mitigating your risk by sizing your positions to fit your trading budget.

Why is risk management important?

Risk management is not just important; it is critical. Without it, even the best trading system in the world will not be enough to make you profitable.

Picture a situation where you have a trading method that helps you win 80% of the time. Now, imagine that all your trades are the same size, say 2% of your account.

You should have no problem building up a profit in your binary options account when you trade this way. Sometimes you will lose money, but over the long run, your wins should surpass your losses.

But now imagine that you are varying your trade sizes based on arbitrary factors, like how you “feel” about each trade setup.

What if you end up losing the trades you risk a large amount on, and winning the trades you risk a small amount on?

Even if you are winning 80% of the time, your losses might end up being so large that they overtake your wins. You could find your account losing money over time.

Key point: Inconsistent or irresponsible risk management can cause you to lose money, even if you have a trading method that produces reliable wins most of the time.

Risk management methods that do not work

Before we tell you our recommended method for managing your risk while trading binary options, let’s quickly go over what you should avoid doing.

1. Going with your gut

You should never arbitrarily change the amount of money you are risking on each trade. For example, you should not decide, “Well, this trade setup looks better than most, so I am going to risk 10% instead of my usual 2%.”

There are two problems with this approach. First of all, what if you lose? 10% is a lot to lose all at once.

Secondly, why are you taking other trade setups that you are not so confident about? All the setups you take should be ones that satisfy your trading method requirements fully. You should have no reason to risk more or less on certain trades.

2. Progressive systems

A progressive system for risk management is one where you increase the amount you risk based on whether your previous trade won or lost. The most famous example of a progressive system for risk management is the Martingale system.

We are here to tell you that progressive systems do not work, full stop. The math is too complicated to explain here, but there are proofs that you require an infinite amount of money at your disposal in order to be profitable with these systems. So, do not use them for binary options or anything else.

3. Large amounts

In general, you should never risk large parts of your account on any individual trade. A lot of new traders vastly overestimate what a “small” amount is. They think it is okay to risk 10%, for example. But a losing streak of just 10 trades would completely wipe out an account when risking 10% per trade. This is not an outlandish scenario.

Key point: When you are trading binary options, avoid risking large amounts on individual trades, varying your risk, or using progressive systems. These approaches are not profitable.

What does work: fixed, percentage-based position sizing

Now you know what to avoid with risk management when trading binary options. But what should you do?

Most professional traders use a simple and conservative system for risk management:

Risk a small, flat percentage of your account on every trade.

What is an appropriately small percentage? Around 1–2%.

Every time you are ready to place a trade, you multiply the total amount of money in your trading account by 0.02. This will tell you what 2% of your account equals. You can then risk that amount on your next trade.

Here are the advantages of using this type of risk management system:

- You never have to worry about losing more than 2% of your account on any individual trade. You can sustain many losses in a row, if necessary, without busting your account.

- The dollar amount you risk scales down if you have drawdown in your account. Contrast this with risking a flat dollar amount as your account size drops. If you did that, you would be taking proportionally higher risks with every loss. But with a

percentage-based system, that does not happen. - As you grow your binary options trading account, the dollar amount you risk grows as well, allowing you to build up your account more rapidly. But you are still not exceeding 2% risk per trade.

You may need a good deal of patience when you manage risk this way, but it will pay off.

Key point: The ideal risk management system for binary options trading is simply to risk a flat 1–2% on every individual trade.

Binary options risk management example 1

To help you visualize risk in binary options trading, let’s take a look at a few screenshots of a demo Pocket Option account starting at $10,000.

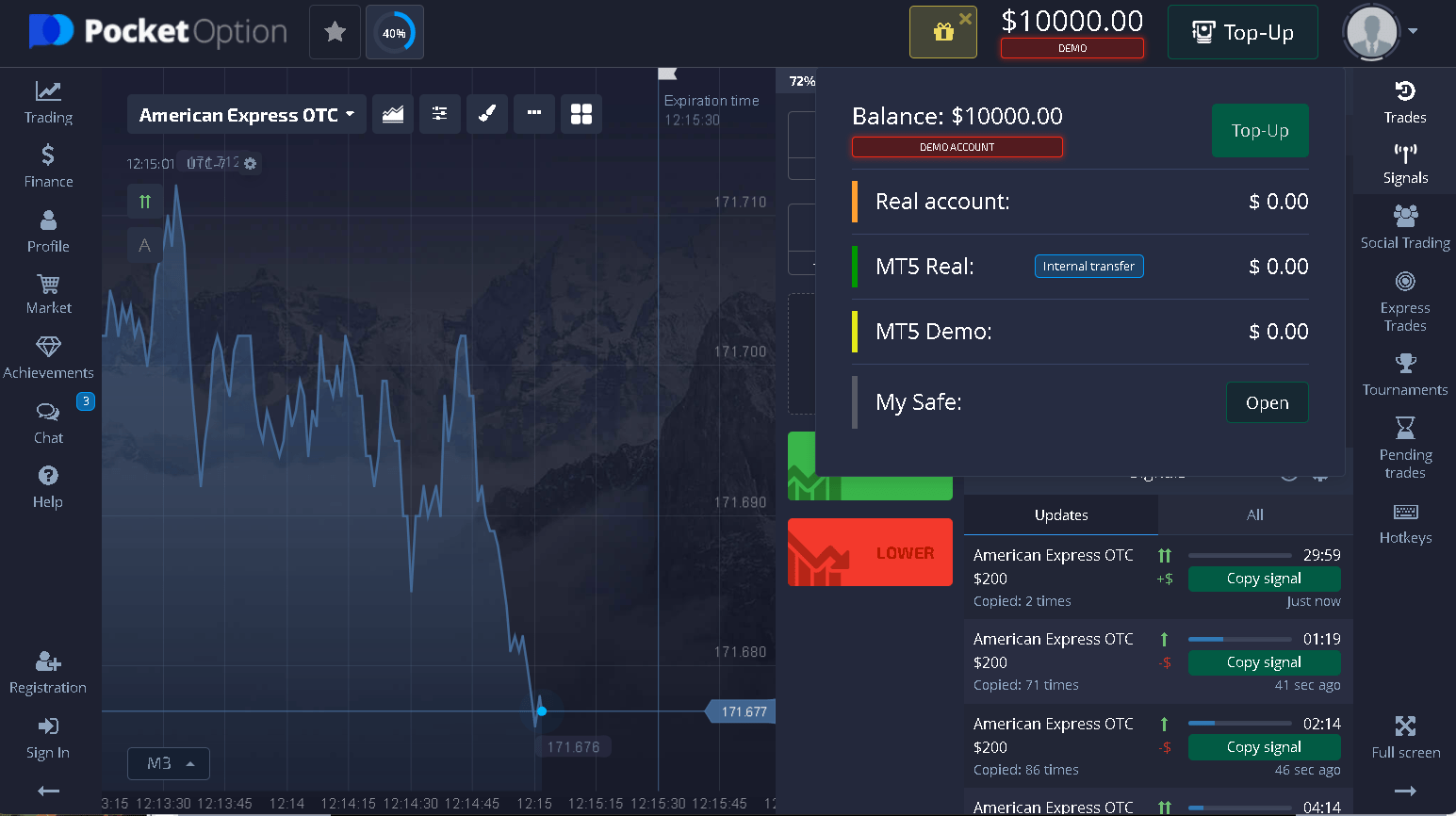

Here is our balance before we have taken any trades. You can see that it says $10,000 at the top.

Here is our balance before we have taken any trades. You can see that it says $10,000 at the top.

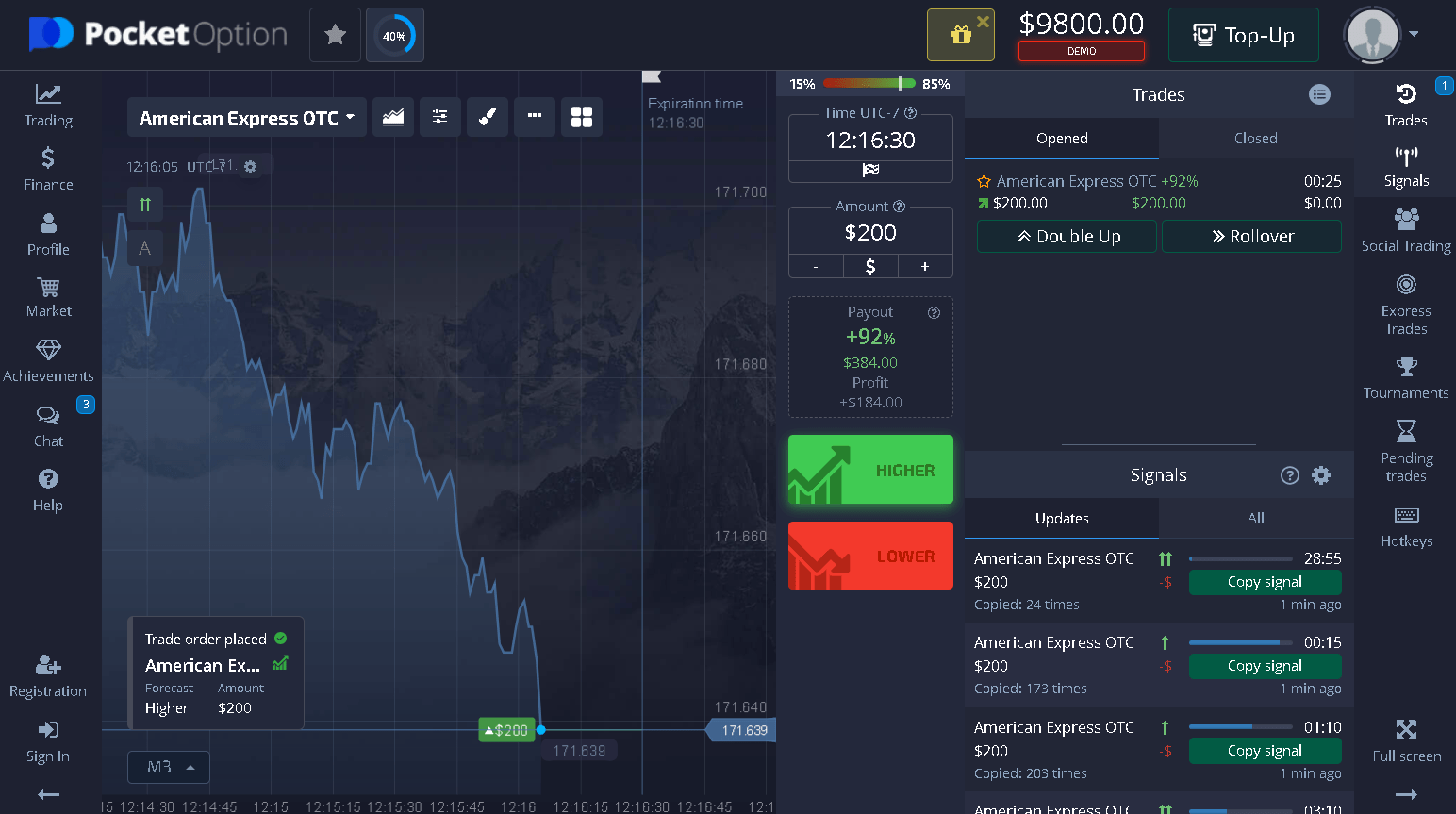

Here is what things look like in our account after we open a position. We have calculated that 2% of $10,000 is $200. So, we input that as our amount when we entered this trade on American Express OTC. You can see that our balance drops to $9,800 since that $200 is now locked up in this trade.

If we lose this trade, our balance will remain at $9,800. Which means that 2% of our account will be gone.

If we win this trade, we will receive a 92% payout, which is $184. The amount we risked will be returned to us along with that profit, so we will have a new balance of $10,184.

Binary options risk management example 2

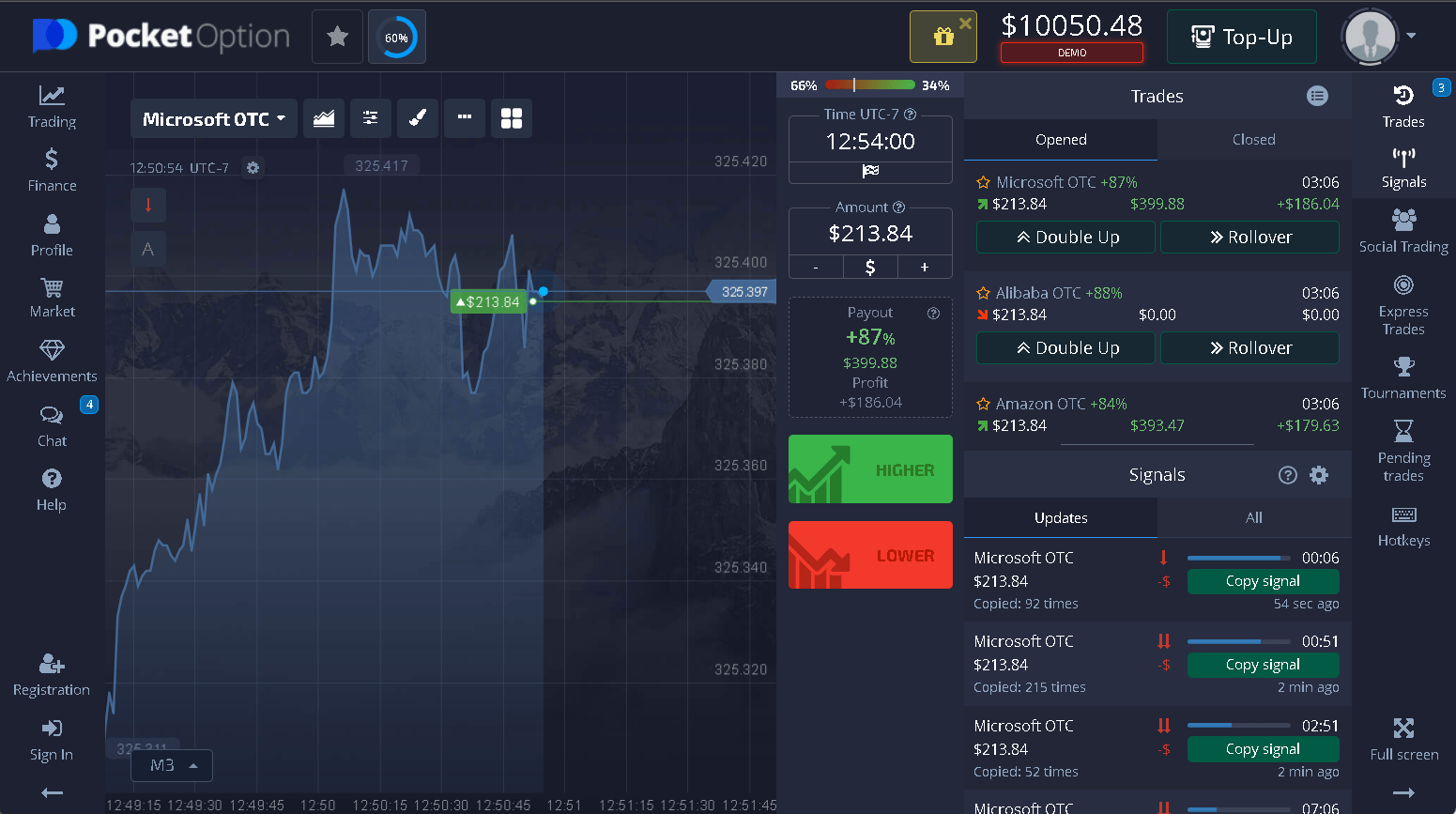

Here is another scenario. We have $10,692 in our account. 2% of that is $213.84. We open three positions of this size simultaneously:

We are risking a total of $641.52, which is 6% of our account. This brings our balance down to $10,050.48 while we wait for our trades to unfold. Let’s see what happened.

We are risking a total of $641.52, which is 6% of our account. This brings our balance down to $10,050.48 while we wait for our trades to unfold. Let’s see what happened.

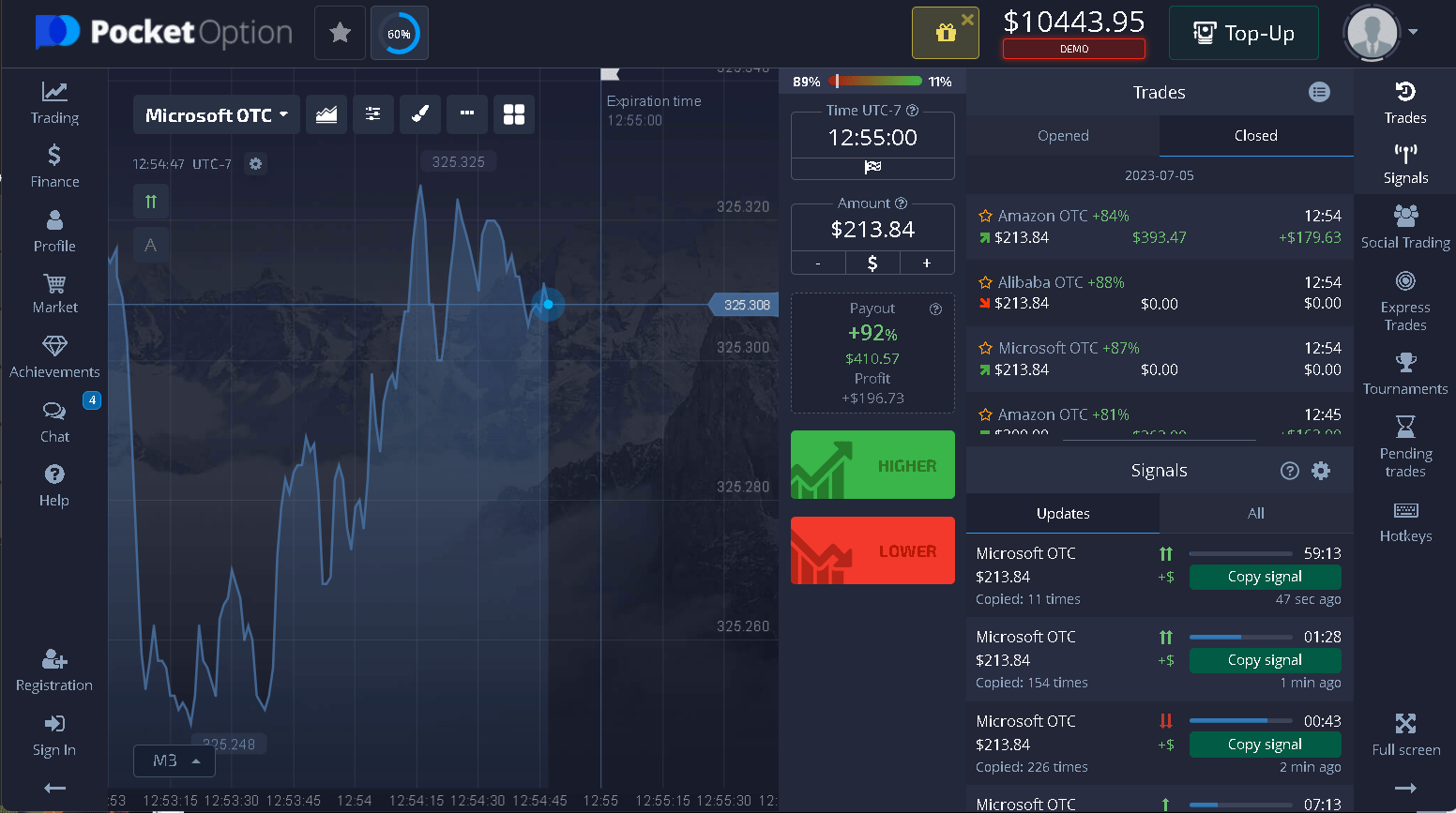

We lost two of the trades, and won one of them. So, we lost 4%, but received what we risked on the third trade back, along with a profit of $179.63, bringing our account balance to $10,443.95.

We lost two of the trades, and won one of them. So, we lost 4%, but received what we risked on the third trade back, along with a profit of $179.63, bringing our account balance to $10,443.95.

Managing risk on multiple trades

Along with setting a cap on risk per trade, some traders set a cap on their overall risk exposure at any given time.

So, for example, maybe you would be comfortable with an overall risk exposure of 6%. In that case, you could have proceeded with these trades. But if you are only comfortable with an overall risk exposure of 5%, you could set that as a cap, and maybe only take two of these trades—or take all three, but cut your risk down to 1% on one of them.

Another variation would be to cap your overall risk at any given time, but not your risk per trade when taking multiple trades.

So, instead of risking 2% on each trade, maybe you would have risked 1%, 1%, and 3%.

If you are going to do something like this though, we recommend you also have daily caps.

It is easy to picture a situation where you exploit a loophole in your money management system to start risking 3% on every trade, or 4%, simply because you are placing more than one trade at a time. This would result in losing a lot of money fast, especially if you do not restrict how many times a day you can do this.

In the long run, we feel it is much simpler to set a rule to stick with 1–2% per trade, whether you have multiple positions open at a time or not. Try not to

Summary

Now you have an understanding of the basics of risk management for binary options trading. Steer clear of progressive systems. Just risk a consistent 1–2% of your account on each trade, and consider capping your maximum cumulative risk if you will have multiple open positions at once.