20 Things Binary Options Traders Know and Benefit from

Rarely would someone come across an investor who lacks interest in binary options trading. Binary options trading, even though unregulated, continues to lure large chunk of investors on a daily basis. Additionally, advancements in telecommunication facilities have made it possible for an ordinary investor to invest in a financial market, which exists in some other corner of the world.

However, with a plethora of financial markets available to invest and trade, the immediate question which comes to mind is which one is suitable and offers more advantages to both experienced traders and amateurs. Even though, selection of financial market should mainly depend upon the individual’s risk appetite, personal traits and specific industry knowledge, ultimately, the decision boils down to the specific advantages offered by a market. In this regard, binary options trading offer a lot of advantages some of which have set new standards in the financial arena. Thus, irrespective of whether an investor is thrilled to be a part of binary options trading or not, it is always better to know the reasons behind the magnetic power of this niche industry which is still in the process of maturing.

- Simple account opening process: All the process related to the opening of binary options trading account can be done online. There is absolutely no need, what so ever, for a trader to visit the broker’s office. Unlike stock and commodity markets where it takes at least a week to open a trading account, a binary option trading account can be literally setup within few minutes. Additionally, verification of the account can be usually completed in a day by sending the relevant identification documents.

Multi-language support is also offered to cater tonon-English speaking clients. Very few stock and commodity brokers offer that kind of assistance. - Round the year promotional offers: Most of the binary options brokers offer a range of promotional offers all through the year to attract new clients. These promotional offers include risk free trades and

non-withdrawable bonus. Such promotional offers are unheard of in stock and commodity markets.

- Free demo account, webinars and ebooks: Predicting the trend is not a skill, which can be acquired overnight. Not only does it demand patience and discipline but also

in-depth knowledge. To prepare an amateur to face the financial jungle, apart from a risk free demo account, binary options brokers offer numerous free educational materials (webinars, ebooks) worth 100s of dollars.

- Multiple deposit and withdrawal methods: As most of the binary options brokers accept clients from all over the world there is an obvious need for providing multiple deposit and withdrawal methods to suit individual needs. The binary options brokers accept deposits through credit/debit card, bank transfer and

e-currencies . Some of the brokers have even started accepting cryptocurrencies.

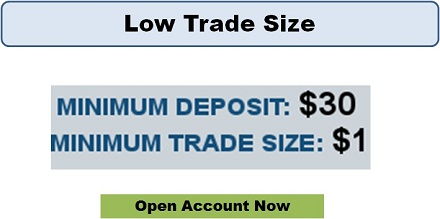

- Low trade size: Unlike traditional ways of investing, binary options trading do not demand huge initial investment. To have a feel of the market, some of the brokers allow a trade size of $1 (minimum deposit would vary between $20 and $100). However, industry standard still stands at $100. Day trading in US stock market is possible only with $25,000 as margin. Even in Europe, most brokers do not accept clients with less than €2,000. Thus, low capital requirement continues to spur the growth of binary options trading.

- High rewards: Binary options trading offer irresistible and unmatchable rewards to successful traders. A winning trade, irrespective of the gain in points, would offer returns as high as 90%. The exponential growth of binary options business can be attributed to the quantum of rewards paid for successful trades.

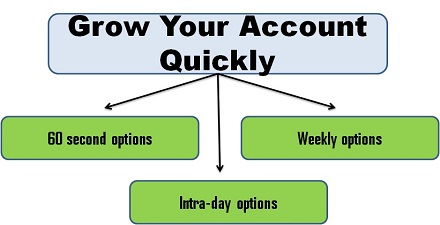

- Quick returns: When money is invested in stocks, commodities or currency market, there is no definite time limit for conclusion of trade and realization of returns. On the other hand, all binary option trades end in a stipulated time. Depending on the interest and personal trading ability, a trader can choose trading time limit ranging from one minute to one week. As long as a trader can correctly predict the direction of price movement, growing an account quickly is not an awesome task.

- Simple system: Trading binary options is not a difficult task. Even an average Joe can learn it quickly. All that needs to be done is selection of an asset to trade, determine the amount to invest and finally buy or sell the asset after predicting the direction of price movement. Once these steps are completed, wait for the option to expire. Stocks, commodities and currencies may be too complex for a novice trader to understand and begin trading straight away.

- Liquidity: Since only the broker acts as market maker and counter party, binary options trading never suffers from lack of liquidity, which is prevalent in other financial markets.

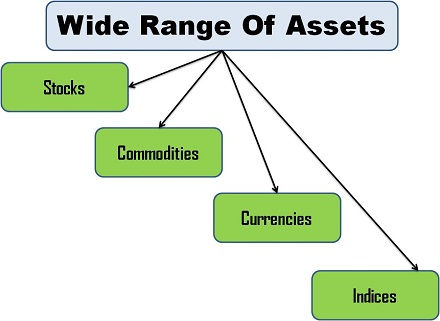

- Wide range of assets: Binary options offer the widest spectrum of assets (more than 50+ usually) to be traded in a single platform. Additionally, a broker can create new class of assets as and when demand arises. Such a liberty has put binary options business on a strong upward spiral. In the case of stock and commodity markets, regulatory bodies need to approve the structure of new assets before being offered to public.

- Limited risk: Before a trader enters into a binary options contract, the maximum risk is

well-known . Thus, a trader will not undergo any kind of mental stress as long as the amount was invested after taking into account the risk appetite of the trader. On the other hand, unexpected volatility can blow a trading account within minutes in the case of stock, commodity and forex markets. Vanilla options traded in the stock market have limited risk as long as a call or put option is only bought and not sold without possessing the underlying asset. - Scalability: Once a trader starts succeeding in binary options trading, it won’t need much of an effort to trade multiple assets at a single time and also increase the amount invested per trade. Since the returns are spectacular, a trader need not wait longer to push the limits. In short, compounding is very much a possibility in binary options. In the case of other financial markets, growing an account takes a lot of time.

- Get back portion of losses: Since binary options are structured by brokers themselves without any need for regulatory approvals, to encourage investors, rebate offerings were introduced. When a trader realizes loss in a trade taken under rebate offer, a fixed percentage of the amount lost is paid back in order to keep an investor’s morale high. Such a facility is not available in any other financial market.

- Trading time flexibility: Stock and commodity markets are open only for a fixed period of time every day. Forex markets are closed during weekends. A trader is free to choose the trade timings as far as binary options are concerned. Few brokers allow binary option trades to be executed even during the week end.

- Price volatility has no effect: A binary options trader is not susceptible to volatility. The price of the asset should have moved few points in favor of the trader at the time of expiry to ensure an appreciable reward. Even if the price action remains unfavorable before the expiry, it does not cause any harm (margin calls etc.,) to the trader’s account. However, in all other financial markets, margin money needs to be maintained to avoid liquidation of positions.

- Choice of expiry time: Binary options trading allow a trader to choose his own expiry period, which can range from one minute to even up to a week. Such a facility not only allows the flexibility to select short or medium term expiration periods but also the frequency of trading. On the other hand, expiry period of stock and commodity derivatives are fixed.

- Customizable trades: A trader is given the liberty to carry forward (indirect extension of the expiry period) the trade, after paying additional costs, in case there is a feeling that the price action would soon turn into his favor. If the price movement is already moving in the direction of the trade, binary options broker even facilitates adding more positions (

double-ups ) before the expiry time. Such customized facilities are seen only in binary options trading.

- Social trading: Binary options brokers were quick to realize the strength of social trading and incorporated the same concept in their business. Thus, interested investors can post their trades for others to study and copy on a real time basis. This phenomenon is yet catch up in stock and commodity markets.

- No additional charges: Binary options trading, being unregulated, does not incur any stock exchange fees and government related taxes. Thus, it is the only financial market where the gross and net profits are one and the same.

- Outstanding hedging tool: Binary options can be used as an exceptional hedging tool. When a trader has doubts about the prevailing trend of an asset in any other market, with a very small investment, a reverse trade can be taken in binary options. In case the market reverses, the notional loss in other financial market can be gained very quickly from the respective reverse positions held in binary options. The trader only needs to study and determine the expiry time and investment amount carefully.

No financial market can completely satisfy the entire investing community. Binary options do suffer certain draw backs. However, a shrewd investor who is careful about selecting a broker and makes calculated investments can gain tremendously from trading binary options.